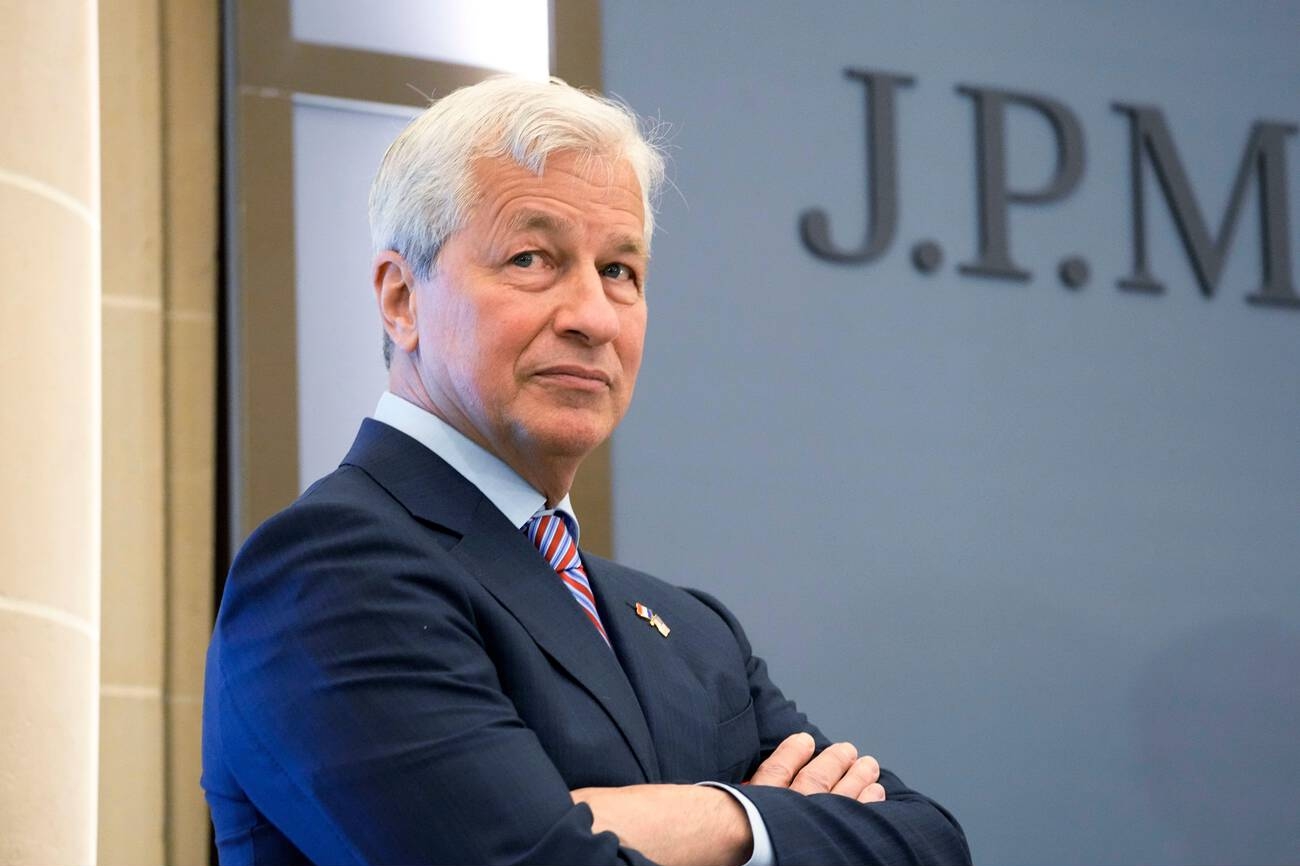

You might have heard the news that Jamie Dimon, the Chairman and CEO of JPMorgan Chase, is raising alarm over the U.S. stock market. He is among the most influential individuals in Wall Street. He is the leader of JPMorgan Chase, which is a bank with gigantic financial, market, and regulatory influence. Owing to his position, whenever he advises against any market issues, people pay attention. He is the mouthpiece not only of his bank, but at least to some extent, of a section of the financial system. That gives weight to all he says.

His words are carefully monitored by many investors since he is wise, seasoned and enjoys a broad network of information- and his views usually forecast the future of the market or indicate genuine risk issues. His threats are weighty since he is the head of the biggest bank in the country. When one occupying his position is concerned, it is worth listening.

In this article, you will know what Dimon cares about and why his issues should be of concern to you, whether you are an investor, a business owner, or just a person who pays keen attention to the economy.

What Is Dimon Telling Us? Warning!

Recently, Jamie Dimon revealed to the media that he is much more concerned about a drastic correction in the U.S. stock market than others are. He indicated that the possibility of a large downturn could be significantly greater than some investors deem it to be. Though the markets might be factoring in a limited risk of a downturn, Dimon believes that it might be much greater.

He is concerned with numerous areas of uncertainty, including geopolitical tensions, a higher level of government spending, and an escalation of world conflict. He further cited current exposure to inflationary risks, changing trade policies and political instability as some of the factors that would lead to a sharp decline in the stock prices.

Inflation, Debt, and Global Risks

Inflation combined with national debt is one of the reasons why Dimon is concerned. The government of the U.S. has been very spendthrift over the past few years and part of the expenditure is unpayable debt or stimulus spending. Debt is weighed heavily when inflation is high or the interest rates are increasing. That has the ability to decrease business earnings and decelerate development.

Even global processes are important: wars, fluctuating trade regulations, and alliances influence markets in an unpredictable way. Markets tend to respond when there is a rise in political or military tensions in any area of the world. It is that type of risk that Dimon is referring to. He states that these larger uncertainties are not fully priced in yet by investors.

The Implications to Investors

Provided you are a stock market investor, the message that Dimon is passing is the possibility that it is time to scrutinize your portfolio. Highly valued stocks may be more prone to a sudden correction. Having reduced risk during a turbulent environment could be achieved by diversifying or adding more risk-free assets, such as cash or bonds.

As a business owner, when stock markets perform well or poorly, it may also be a sign of what may transpire for your customers or financing expenses. Market realignment may constrain capital, spending, or alter the investor attitude towards your industry. It might be necessary to be more cautious about the growth rate or to get exposed to financial volatility.

Furthermore, operating in an uncertain world, it is one of the most effective methods to defend yourself by enhancing your professional competence. Training can assist you in case you would like to decipher earnings reports, analyse risk or construct financial forecasts.

For example, line management is an essential soft skill for leadership, decision-making, and data analysis. Every line manager should take this course to learn to respond more effectively to uncertainty, whether you are coordinating a small team or making business decisions. The more you are able to handle stress when pressed or understand financial statements, the more you are ready to adapt to changes in the market.

In Summary

JPMorgan Chase is a large institution, yet it cannot afford to ignore market trends, no matter how small they may seem. It is not possible to control the market, but even for a small company like yours, you can do something to defend yourself today. One, ensure that your business model or financial plan is resilient to disruption. Review your investments. Make your business more effective. Know your risks and think of stress tests.

Second, invest or diversify revenue. Consider less risky assets, other industries, or international diversification. High-growth stocks should not be solely relied upon due to their potential to have increased downside.

Third, stay informed. Listen to the statements of such leaders as Jamie Dimon, pay attention to economic statistics, and shape your approach before it is too late.